As cloud adoption grows, so do cloud costs. For businesses operating across multi-account setups, managing and optimizing cloud spend can become a daunting challenge. Visibility gaps, lack of accountability, and unoptimized resource utilization can lead to spiraling costs that threaten innovation and profitability. This is where FinOps (Cloud Financial Operations) steps in, helping organizations bring financial accountability to the variable spending model of the cloud.

If you’re looking to kickstart a FinOps practice in your organization, AWS Native Services provide a strong foundation. Coupled with SpendEffix by Cloudlytics, a comprehensive Cloud FinOps platform, you can establish a streamlined, scalable, and transparent FinOps strategy.

Why FinOps Matters in a Multi-Account AWS Setup

Operating in a multi-account AWS environment has its advantages—better resource isolation, improved security, and tailored access controls. However, it also introduces complexities in managing costs, such as:

-

- Limited visibility into how resources are being consumed across accounts.

- Difficulty in aligning spend ownership to respective business units or teams.

- Challenges in optimizing resource utilization and curbing waste.

An effective FinOps practice addresses these challenges by enabling organizations to:

- Gain granular visibility into cloud spend

- Optimize costs through actionable insights.

- Implement showback or chargeback models for financial accountability.

Cloud Cost Visibility vs. FinOps: What’s the Difference?

| Aspect | Cost Visibility | FinOps Maturity |

|---|---|---|

| Goal | Understand current spend | Optimize cloud investments aligned to business goals |

| Tools | Cost Explorer, CUR reports, dashboards | Budget automation, anomaly detection, optimization workflows |

| Users | Cloud Ops, Finance | Cross-functional: Engineering, Product, Finance, Procurement |

| Insights | Reactive (what happened?) | Proactive (what should we do now?) |

| Scope | Cloud billing | Cloud usage, unit economics, team accountability |

| Maturity | Static reports | Continuous improvement loops (Inform → Optimize → Operate) |

Cost visibility is foundational — but not sufficient to drive a FinOps culture. Companies need to move beyond visualizing spend and towards influencing how cloud is used.

AWS Native: Cloud Intelligence Dashboards

AWS offers an excellent first step with its Cloud Intelligence Dashboards (CID), powered by:

- AWS Cost & Usage Reports (CUR)

- Amazon Athena for querying usage data

- Amazon QuickSight for dashboarding

These dashboards — including CUDOS, KPI, and Budgets — give Finance and CloudOps teams curated insights to:

- Break down costs by service, account, or tags

- Visualize usage trends and anomalies

- Track RI/SP coverage and unused commitments

📌 Get started with AWS Cloud Intelligence Dashboards:

https://catalog.workshops.aws/awscid/en-US/dashboards

(Credit: AWS Well-Architected Labs)

How it works?

![AWS Cloud Intelligence Dashboard Reference Architecture Suggested image: [Example architecture from AWS documentation showing CUR → S3 → Glue → Athena → QuickSight]](https://cloudlytics.com/wp-content/uploads/2024/12/CIDframework-1024x363.png)

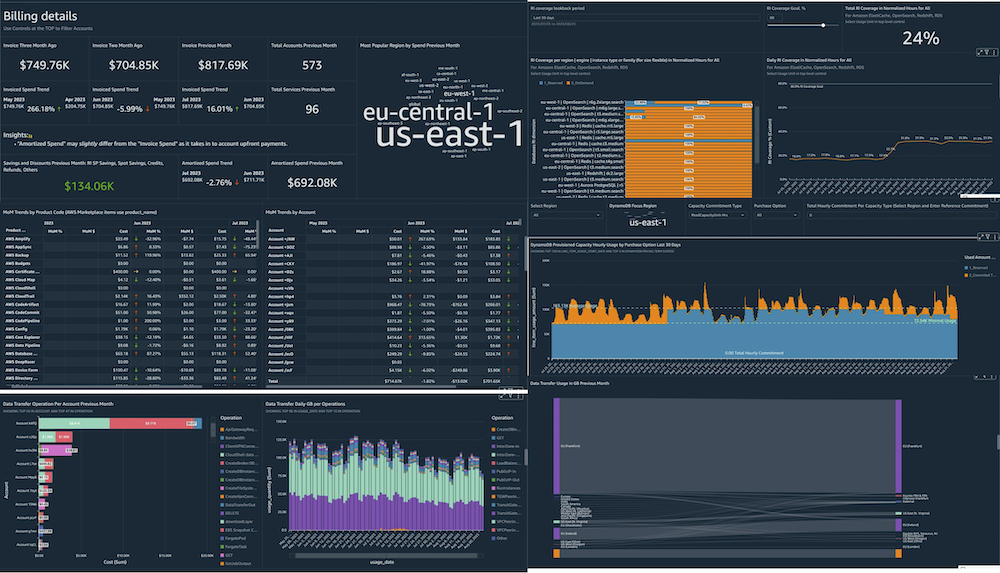

QuickSight Dashboard Sample

Why SpendEffix Kickstart is the Next Logical Step

As organizations scale their cloud footprint, cost visibility must expand to governance, automation, and accountability. This is where SpendEffix Kickstart becomes essential.

SpendEffix builds on the foundation of AWS native dashboards and delivers a SaaS layer purpose-built for mature FinOps practices.

A Cloud-Native + SaaS Powered FinOps Stack

Here’s what a modern cloud financial operations stack could look like:

- AWS Native Layer (Foundation)

- CUR → Athena → QuickSight

- Cloud Intelligence Dashboards (CUDOS, KPI, Budgets)

- SpendEffix Kickstart Layer (FinOps Accelerator)

- Unified multi-cloud view

- Pre-built dashboards for CFO, FinOps, and Engineering

- Automation workflows for cost cleanup, commitment planning

- Slack/MS Teams/ITSM integrations

- Strategic FinOps Ops Layer

- FinOps maturity scoring

- Savings realization tracking

- Forecasting, variance analysis, showback

Closing Thoughts

If you’re an organization starting your FinOps journey — start with AWS native dashboards. But if you’re seeking:

- Deeper accountability across teams

- Multi-cloud visibility

- Tangible savings tracking

- FinOps operations at scale

Then SpendEffix Kickstart offers a ready-to-use solution to bridge that gap.

You don’t need to build from scratch. You need to extend and accelerate.

Resources:

- AWS Cloud Intelligence Dashboards Workshop

- AWS Well-Architected Labs – Cloud Intelligence

- SpendEffix Website

Interested in seeing how you can get better ROI on your Cloud Spend with SpendEffix?