Executive Summary

Supply Chain Finance (SCF) has evolved beyond traditional bank portals into embedded finance ecosystems where customers access financial products within their existing workflows—ERP platforms, e-commerce marketplaces, and FinTech applications. This transformation represents more than technology adoption; it’s about unlocking new revenue streams, ensuring regulatory compliance at scale, and creating customer-centric experiences that meet businesses where they already transact.

The Case for Modernizing Supply Chain Finance

- Customer Reach Beyond Branches

SCF is no longer limited to bank portals. Embedded finance enables lenders to integrate directly into supplier or marketplace workflows, offering seamless credit at the point of need. This shift allows financial institutions to serve customers within their existing business processes rather than forcing them to adopt new platforms. - Revenue Diversification

By offering SCF as an API-driven product, institutions can tap into transaction volumes on partner platforms—unlocking new fee-based income streams. This model transforms traditional lending from a product-centric to a platform-centric approach. - Agility in Innovation

Cloud-native architectures empower BFSI players to quickly roll out tailored financing models, pilot new products, and adapt to evolving market needs. The ability to iterate rapidly becomes a competitive differentiator in dynamic markets. - Regulatory Compliance at Scale

With each geography having unique regulatory standards—RBI, SEBI, PCI DSS, GDPR, HIPAA, ISO—compliance is not just a necessity but a competitive differentiator that enables global expansion.

The Embedded Finance Ecosystem

Partnership-Driven Innovation

The collaboration between traditional banks and FinTech platforms exemplifies the new paradigm where:

– Banks provide regulatory compliance, capital, and risk management expertise

– FinTechs deliver superior customer experience, technology agility, and digital-native market reach

Result: Curated financial products that integrate seamlessly into customer workflows

Beyond Traditional Channels

Modern SCF platforms integrate directly into:

– ERP Ecosystems: SAP, Oracle, Microsoft Dynamics with native financing workflows

– E-commerce Marketplaces: Amazon Business, Alibaba, IndiaMART with embedded credit

– Procurement Platforms: Ariba, Coupa, with integrated supplier financing

– FinTech Applications: Direct API integration for seamless customer experience

Real-Time Intelligence

AI-powered platforms enable:

– Instant Credit Decisions: Sub-second approvals based on real-time data

– Dynamic Risk Pricing: Continuous adjustment based on market conditions

– Predictive Supply Chain Analytics: Early warning systems for disruption management

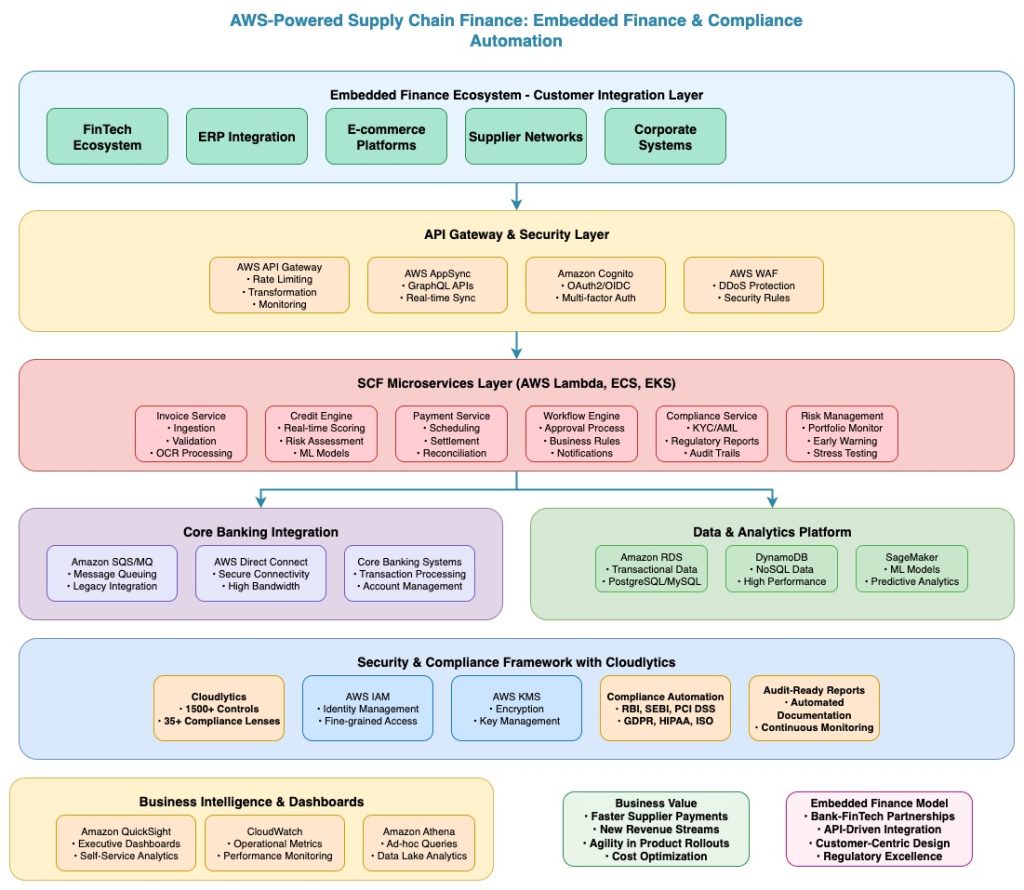

AWS-Powered SCF Architecture

Modern SCF platforms are designed on AWS to bring together scale, security, and innovation:

Customer Integration Layer

– AWS API Gateway / AppSync: Secure integrations for FinTech, ERP, and marketplace ecosystems

– Authentication & Authorization: OAuth2, SAML, OIDC with Amazon Cognito for seamless SSO

– Rate Limiting & Throttling: Protect backend systems while ensuring optimal performance

SCF Microservices Layer (AWS Lambda, ECS, EKS)

– Invoice Ingestion & Validation: Automated document processing with intelligent OCR

– Real-time Credit Scoring: AI-powered risk assessment with sub-second decisions

– Payment Scheduling & Settlements: Automated workflow management and reconciliation

– Compliance Engine: Real-time regulatory monitoring and reporting

Core Banking Integration

– Amazon SQS / Amazon MQ: Bridge legacy core systems with modern APIs

– API Connectors: Real-time transaction reconciliation and settlement

– Event-Driven Architecture: Asynchronous processing for high-volume transactions

Data & Analytics Platform

– Amazon RDS / DynamoDB: Transactional data with high availability and performance

– Amazon Redshift & Athena: Advanced analytics and business intelligence

– Amazon QuickSight: Executive dashboards with real-time insights

– Amazon SageMaker: Predictive credit risk models and fraud detection

Security & Compliance Framework

– AWS IAM, KMS, CloudTrail, GuardDuty: Comprehensive governance and monitoring

– Cloud-native Encryption: End-to-end data protection and key management

– Automated Compliance: Continuous monitoring and audit-ready reporting

Compliance Automation with Cloudlytics

While AWS provides the backbone for scale and innovation, compliance remains the most pressing challenge for BFSI leaders. Each geography has unique frameworks—RBI, SEBI, PCI DSS, GDPR, HIPAA, ISO, among others.

Strategic Compliance Value

– 1500+ Pre-built Controls: Comprehensive coverage across 35+ compliance lenses

– Automated Policy Enforcement: Continuous monitoring of cloud environments

– BFSI-Specific Customization: Tailored compliance scoring for financial services

– Audit-Ready Reporting: Reduced manual overhead and compliance risk

For BFSI organizations, this means launching modern SCF products faster while staying regulator-ready across regions.

Business Value for CXOs

Faster Supplier Payments

– Strengthened Supply Chain Trust: Improved supplier relationships through reliable, fast payments

– Enhanced Liquidity Management: Optimized cash flow across the entire supply chain ecosystem

– Competitive Advantage: Preferred buyer status through superior payment terms

New Revenue Streams

– Embedded Finance Monetization: Revenue generation through API-driven partnerships

– Transaction Volume Growth: Increased business through FinTech ecosystem integrations

– Fee-Based Income: Diversified revenue beyond traditional lending margins

Agility in Product Rollouts

– Rapid Development Cycles: Cloud-native architecture enabling faster time-to-market

– FinTech Ecosystem Integration: Seamless connectivity with digital-first platforms

– Market Responsiveness: Quick adaptation to changing customer needs and market conditions

Cost Optimization

– Efficient Resource Management: Cloud scaling aligned to transaction volumes

– Automated Operations: Reduced manual processing and operational overhead

– Compliance Efficiency: Automated monitoring reduces audit and regulatory costs

Regulatory Assurance

– Continuous Compliance Monitoring: Real-time adherence to regulatory requirements

– Reduced Audit Overhead: Automated reporting and documentation

– Multi-Geography Support: Scalable compliance across different regulatory frameworks

Strategic Outlook

Over the next 12–18 months, BFSI leaders who modernize SCF platforms will position themselves to:

Lead in Embedded Finance Ecosystems

– Platform Strategy: Become the preferred financial services provider for FinTech partnerships

– API-First Approach: Enable seamless integration across multiple customer touchpoints

– Ecosystem Orchestration: Coordinate complex multi-party financial workflows

Monetize Partnerships While Reducing Risk

– Shared Value Creation: Revenue models that align bank and FinTech partner incentives

– Risk Distribution: Collaborative risk management across the partnership ecosystem

– Compliance Leverage: Shared regulatory burden through automated compliance frameworks

Deliver Seamless, Compliant Financial Experiences

– Customer-Centric Design: Financial products integrated into existing business workflows

– Regulatory Excellence: Continuous compliance across multiple jurisdictions

– Operational Transparency: Real-time visibility into all aspects of the supply chain finance process

Future-Proof SCF Offerings

– AI-Driven Credit Scoring: Advanced machine learning models for risk assessment

– Predictive Risk Modeling: Proactive identification of potential supply chain disruptions

– Automated Compliance: Self-healing compliance systems that adapt to regulatory changes

Call To Action

The modernization of Supply Chain Finance is not just a technology initiative—it is a strategic imperative. By leveraging AWS native services for scale and agility and Cloudlytics for compliance automation, BFSI institutions can deliver SCF that is:

Embedded and Customer-Centric

– Seamless Integration: Financial products available within existing customer workflows

– Reduced Friction: Elimination of separate banking portals and complex onboarding

– Enhanced Experience: Meeting customers where they already transact and operate

Compliant Across Global Regulatory Frameworks

– Automated Monitoring: Continuous compliance with 1500+ pre-built controls

– Multi-Jurisdiction Support: Scalable adherence to RBI, SEBI, PCI DSS, GDPR, and other frameworks

– Audit Readiness: Automated reporting and documentation for regulatory reviews

Built for Speed, Agility, and Innovation

– Cloud-Native Architecture: Rapid deployment and scaling capabilities

– API-Driven Integration: Seamless connectivity with FinTech and enterprise platforms

– Continuous Innovation: Platform designed for ongoing enhancement and feature development